The World is Unravelling, or How Trump's War on Europe Will Transform the Global Economy (and Crash America's)

Trump. Europe. Greenland. Fascism, expansionism, rage, modernity unraveling, the jagged fist of violence ripping apart the peace and progress of the world and the West. Here’s the situation the world now faces, and what it means for finance and economics. The short version is that many of you are probably going to lose a lot of money, in fact, probably are at this very moment. I suggest you read the following carefully.

The world has changed dramatically now.

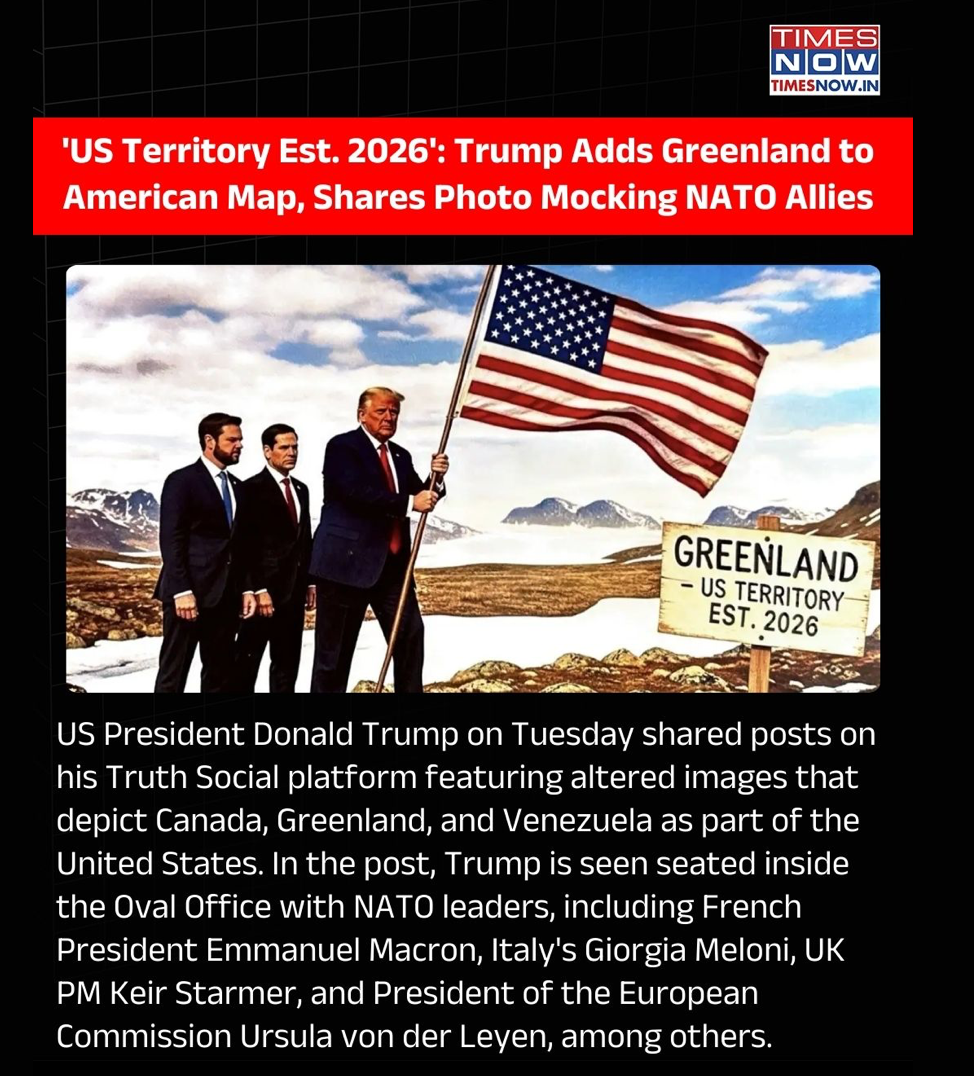

Europe now appears to be headed to the brink of war with a fascist America. Trump’s threats to take over Greenland appear to be very real. It’s one thing to start a trade war over, well, trade. But to start a trade war with the explicit intent to seize another’s territory is very much a dramatic escalation. It is one small step short of war, and I’ll return to that, explaining to you how wars really break out.

Later this week, Davos is happening. And there, amongst heads of state, Trump will try to walk back his various threats and comments. He’ll say, I’m doing it for your sake, like any good abuser does. Or there’s a chance, too, that he’ll escalate even further. But the damage has now been done. What Trump has set in motion now is a chain of dominoes far beyond his control, or any of ours.

Europe has learned the hard way that its leaders have been very, very foolish. It has trusted a fascist America. And please, if you’re American, let’s not nitpick over the word fascism. Masked Gestapos killing mothers is hardly the stuff of democracy. Over the last year, Europe’s leaders made the mistake of…the classic mistake of…trying to appease a violent, expansionist fascist regime. After “Liberation Day,” Europe hoped Trump would calm down, if it agreed to lower tariffs on American goods to zero. Instead, Trump double crossed Europe, and now threatens territorial invasion.

This is a red line for Europe. Please read that link. Trump doesn’t understand the EU. There is very little chance that the EU gives up on foundational concepts like self-determination and sovereignty. They are precisely what the EU is founded on. Brexiters found out the hard way that the EU has very clear red lines, and America is about to, as well.

Europe is now united in ways that it hasn’t been in decades. From far left to far right, Trump’s expansionism has triggered a shockwave of betrayal and revulsion. Americans fail to understand just how deeply angry and upset Europeans are. Emanuel Macron speaks for much of Europe when he says that it’s time to begin using the heavy weapons on America—and in the end, in Europe, France tends to set directional long term decision-making. I know that, because I’ve been there. The heavy weapons. What do I mean?

We are now about to proceed from a trade war, to a capital war. Trade wars are about limiting flows of products. Capital wars are very different. They are about decoupling and divesting, about money and wealth, not just products and stuff.

The step from trade war to capital war is an incredibly severe one. It is an escalation of macro risk to much higher level, and that is what Havens is for, the study of macro risk. We are now on the brink of just such an escalation, which is rare in history.

Capital wars are the prelude to real ones. Real wars, physical ones, are costly. Throughout history, finance and war have gone hand in hand. The great investment banking houses of the last half millennium were built by financing wars for empires, to put it gently.

Wars over capital go like this. One side decides it cannot trust the other anymore. It repatriates what belongs to it. It decides to no longer invest as much. Capital flows between the two sides begin to shrink, and then reach what is known as a “sudden stop.”

Capital wars are often what trigger real wars. Because the other side says, no, what is yours still belongs to me, or, no, you cannot have it back, or, we will come and take something even more valuable back from you.

In the last post, I taught you that the relationship between Europe and America isn’t symmetrical. Europe is the world’s largest investor in America: it’s about 50% of the world’s investment in America. It’s America’s largest creditor, too. It outstrips both China and Japan by a (very) long way. American consumption is financed by European largesse. America, meanwhile, is a relatively small investor in Europe.

Do you see the conclusion to be drawn here, that these macroeconomics leave little doubt about?

Trump cannot win this capital war. If Europe so much as twitches, America will shudder. If it stops buying American bonds, every American will be paying astronomically higher interest rates, and because Americans are debtors, that alone will bring the economy to its knees.

And those aren’t even really the nuclear options. We’ll discuss those in future posts. They have to do with how the global banking system actually works.

Let me say it again. Trump is going to lose this capital war. But the problem is that he has already started it. And now de-escalating it will be very, very difficult indeed.

It would take a dramatic alteration of history now to stop what will happen. Europeans are now deeply angry and upset, like I said. And those feelings are not going to subside anytime soon, and for good reason, too. They are going to demand that their leaders, even if they want to, take a much, much harder line with America. That they don’t make the same mistake, history’s most foolish, twice, which is to appease fascist expansionism bent on conquest.

In this, Europeans are wiser right now than their leaders. This year, it’s very likely we’ll witness a “divest from America” movement in Europe, even if Europe’s leaders don’t want to do such a thing. The nature of geopolitics has now changed dramatically. The world loathes and despises what America has become, even if draws a careful line at “Americans.” And it will want little of its capital to end up financing those who are now its enemies in the raw sense of threatening the basic inviolable principles of sovereignty and self-determination.

Because sentiment now is rising to a fever pitch, the capital war that Trump has started is unlikely to stop. It’s true, probably, that more orthodox European banks and so forth will want to slow this tidal wave down. But they can’t, in the end, very much.

Because everyone else in the world will want to get ahead of it. If you’re China, Japan, Asia, or anywhere else in the world, and you think that in the end, Europe will be forced to decouple from America, what will you do, first? Unless you want to end up holding the bag America’s credibility just imploded inside, you will have to move first at some point, too.

This is what is known as a “risk cascade.” It is a domino effect. It’s how stock market crashes happen, how runs on banks happen, and how currencies crash. But in this case, it’s applicable to an event much, much bigger than any of those, which contains them, but is vastly greater still: the sudden, catastrophic loss of faith and confidence in a world power. That’s a term we don’t have a word for in economics, really, though we should, and we don’t have one because it has happened rarely in history to a wealthy, Western country.

In this sense, we’re living through history.

The risk cascade now being set in motion isn’t really about stock markets, which is the way Americans think of crashes. It is hard to put into words. It’s the crash of a country, in the eyes of the world, with severe, dire consequences for everything in it. Everything in an economy has a price, and what will happen now is that the price of everything in the economy must be adjusted for this severe, new level of macro risk the world now faces coming from America, the risk of Trump, of being double-crossed, of violent expansionism.

The only good answer for that risk is what seems intuitive to Europeans: do not finance those who are your enemies, because of course, that’s foolish. All it does is keep you at higher and higher levels of risk. So Europeans are just asking for good risk management, which is wise.

That brings me back to Americans. It’s possible nothing whatsoever could happen this week, month, quarter, or year. Anything’s possible, given the severe irrationality of American markets. But in any semblance of a rational world, we should expect pretty severe consequences for the dollar, and the beginnings for bonds and stocks, too. If those come to pass, then of course, most of you will lose money this week, and that is the price you will already be paying for the violence, greed, and hatred of fascist expansionism.

I decided to do some research. I called several of my American friends this weekend, all wealthy, and asked: so…did your finance guys do anything? Did they, for example, call you up, and say, listen, sorry, this is an emergency, we need to minimize your exposure, right now, Trump is basically declaring war on Europe? That’s what a responsible and competent professional should have done, at the barest of minimums. But do you know what I heard from my friends? Nothing. Nobody had called them, warned them, advised them, or done much of anything on their behalf. And that made me feel gravely worried for them, not to mention making me frown and think: something is very wrong here.

Now. I don’t like to hector or lecture you. But you deserve better than this. This is where, I suspect, most of you are: American finance is failing badly to protect you from the price to be paid for the world now regarding America as something akin to, or on the road to, Nazi Germany. In times like these, over a weekend like this, a child can see what’s coming financially. And yet many of you are just being left standing right in front of a train that’s about to hit you full speed.

That’s not right. Sadly, America’s finance industry is in bed with Trump, if not ideologically, then just for pragmatic reasons, not to rock the boat. Should you want to sink with it for that reason? Go ahead and chuckle, and then sigh a little bit, that’s perfectly OK too.

I’m telling you exactly what I told my friends. I tried to teach them about the macro risk cascade they now face. Some reacted in a very American way. They got angry at me. LOL, go ahead and chuckle. Are you saying you know better than my entire team of finance guys? Their sullen looks asked. What would I know, I’m only one of the world’s—never mind, that doesn’t matter anymore. Like I said, a child is able to see coming what will unfold now. And if it doesn’t begin to unfold this week, month, quarter, the eventual price of the macro risk cascade about to unravel the global economy will only rise until it finally does.

I created Havens because you deserve better. Whether or not you subscribe is up to you, and this is far from a plea for that. It’s—genuinely— here first and foremost just to educate you. You’re almost certainly now already losing money in real terms that you shouldn’t be. That is what “your wealth is now at severe risk” means. Bleeding out. The choice about whether or not you will take responsibility for it is yours. What I’ve gathered over the last year is this. The American financial industry is unbothered about helping you, in any vaguely professional or competent way. If you get run over by Trump’s fascist train, then American finance content to shrug, whistle, and walk away from the roadkill.

Understand why I created all this for you. So that you are safe. That’s the least you deserve. It’s called Havens for a reason. The point is to learn from it. Can you point me to a single example of a rich fascist country? That stayed rich? There aren’t any, precisely because wealth and democracy go hand in hand. They go hand in hand because capital needs the sanctity peace, justice, and order to truly grow. And when there is the absence thereof? Wars over capital erupt, as preludes to real ones. Macro risk cascades of the kind I’ve discussed with you are very real in this way.

Would you invest in a well-managed company in a democracy, or a…den of thieves in a failing state? What would you have made on, say, investing in gun companies and arms manufacturers over the last three centuries, versus in a portfolio of modern, peaceful, innovative, creative endeavors? The latter would have dwarfed the former by millions, if not billions, of percent.

This principle is how economics and finance really work, and how good investment should always be ordered. If it didn’t, would we have ever grown wealthier as a civilization? If the world had just been warring empires forever, how much less wealth would each of us have, and how much would have ever been created at all? Democracy and peace created the wealth we take for granted, preconditions for science, art, literature, research, innovation, investment. No, dude, not Elon (go ahead and snortle your coffee.)

Trump doesn’t understand any of this. That is his malignancy. American economics scarcely understands it, with its insistence on individualism, greed, and amorality, and so your finance guys are lost at sea. This is the price of not heeding the lessons of macroeconomics and finance over the centuries. Yet the laws of economics and finance remain what they are. You must understand them now.

We are now entering the capital war phase of this grim, idiotic repeat of the 1930s. This is where we are. The time for denial and whataboutism is very much over now. Pessimist! Doomer! Foolish insults will not do anymore. Especially when you are the one losing money every time you repeat them. None of this is some kind of feeble, ideological, costume New York Times debate. Those days are gone for good. The world really is on fire. Guess what its kindling is made of?

America is gone in many ways now that mattered. It will not regain the world’s trust now, easily, if at all. Things will not be the same. The fracture is real. Civilized countries do not attempt to conquer others. And uncivilized ones do not enjoy the same wealth, because in the end, war, violence, conquest, and their lesser demons, hatred, envy, and malice, are always poorer investments than peace, cooperation, sovereignty, and progress. Reflect seriously on what that means for America, the world economy, and how it will dramatically change now. On how Europe understands this, and defends it, too.

Time is now growing short. Perhaps now, if I’ve taught you well, you know why. Even some of my friends, sadly, didn’t. Their loss, literally. I can only help them so much. In the end we all must choose, what kinds of lives we are to live. I can guide you, but the decisions remain yours. I know they’re not easy. But I also know this. You must make them now, and I grasp how difficult that is, when so many people are failing you, in so many ways, all at once.

PS Please understand that when I say “undo” or “crash America’s economy,” I don’t mean that a Hollywood scenario will happen overnight, that it’ll be Mad Max tomorrow. If I’ve taught you well, you’ve grasped the subtler nuances of risk, cascades, and consequences. We speak now at historical scales.. In the end, language fails us at this point, and—forgive me—I tussle with and struggle for words with which to convey to you the gravity of the place we’re at.

Love,

Umair (and Snowy!)

❤️ Don't forget...

📣 Share The Issue on your Twitter, Facebook, or LinkedIn.

💵 If you like our newsletter, drop some love in our tip jar.

📫 Forward this to a friend and tell them all all about it.

👂 Anything else? Send us feedback or say hello!

Member discussion