The Majority of Americans are "Cashflow Negative"

A Shocking and Disturbing Finding About Economic Ruin

I came across a startling statistic today—one that raised the hairs on the back of my economist slash Top 50 Thinkers neck. There are statistics, and there are statistics. Numbers—and figures that tell stories about chapters in history, how societies go astray, how grand experiments fail. This is one of those.

"A recent Aspen Institute Report found that 51% of households report negative cash flow, meaning they spend more than they bring in."

Whew. This startling figure comes to us from the Wall St Journal, in a very interesting article entitled "I thought living paycheck to paycheck was behind me. I was wrong."

This is a shocking number. Is it real? It's one of those alarming yet somehow unsurprising figures.

Here's how the Aspen Institute puts it.

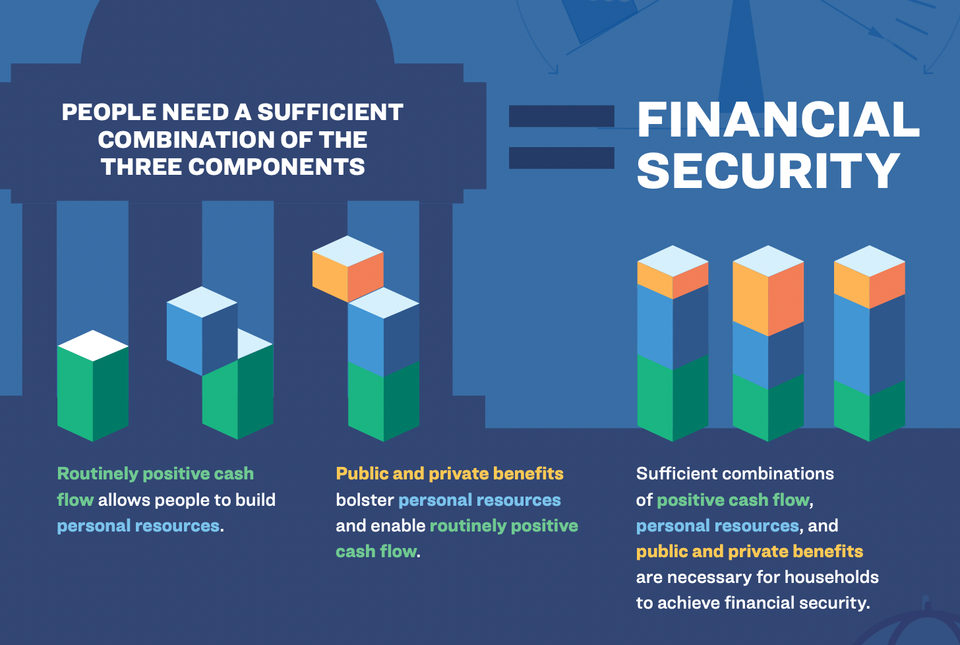

Though routinely positive cash flow is the starting point for financial stability, it remains largely out of reach for many Americans. Even before the fallout of the COVID-19 pandemic, nearly half (46.5 percent) of households reported that their income did not exceed their spending over the course of a year. For households with annual income of less than $30,000, this number increases to three in five (61.5 percent)

—Aspen Institute

So. Even before the cost of living crisis that's swept the globe, about half of Americans reported negative cashflow. The cost of living crisis has affected everyone—but it's effects have been especially acute in America, where prices surged savagely, and real incomes fell sharply. So the larger figure—the majority of Americans are now cashflow negative looks real.

And there's plenty of other evidence, of course, to lend it weight. For example, roughly half of Americans earning $100K or more now say they live paycheck to paycheck. $100K is more than three times the median income, and so if half of people earning more than 3x the average are living paycheck to paycheck, it's not hard to see how the majority of people per se could be cashflow negative.

So. It looks real. And it feels real, too. We've just been discussing how America's become a deeply distressed society. 70% of people say they're "financially traumatized," and the same number say that the economy, income, money, etcetera, are significant and serious sources of stress. Meanwhile, young people say they're "numb" and "can't function anymore"—classic signs of very real trauma, with financial stress again at the top of the list. So people feel just the ways we'd expect them to if this figure were real—distressed, anguished, traumatized.

Now. What does this all mean? Let's take it level by level.

The most basic level is just the economy itself. Why has the economy become such a flashpoint? Why have Americans turned back to Trump? A man who attempted a coup, abused and disgraced the office of the Presidency, and attempted to overthrow democracy? They'll tell you—from independent voters to young people—that, astonishingly, they "trust him on the economy more." But something much deeper and more sinister is going on here when you really think about it.

I used to say that America's the world's first poor-rich country. Here appears to be pretty vivid, stark evidence. The majority of people are in dire straits, right up to seeming negative cashflow. Meanwhile, the Democrats, foolishly, have been touting how "strong" the economy is. Nobody's buying that message apart from lobbyists and pundits.

We should never, ever see this happen. Recently, the hashtag #economycollapsing was trending on TikTok, especially amongst young people. It's not so hard to see why. The lived experience of being perpetually cashflow negative, forever spending more than you earn, or at least until...we'll come to what happens...is a form of very real economic collapse. When an economy can't provide a break-even level of income for the majority of people, things have gone badly, shatteringly wrong.

We should never, ever see this happen—why? Well, what happens is what is happening. Political destabilization results. People give up on democracy. Rome is the classic example, in ancient history, and Weimar Germany in modern history. How did Rome fall? The average Roman was left impoverished and begging for bread—hence "bread and circuses"—while the patricians and elites turned up their noses, and fought endless wars, whose benefits flowed to them. Meanwhile, figures like Caesar built up huge populist groundswells of support, as champions of the ignored, abandoned, neglected average person. Sound familiar? It should. Entrenched cycles of poverty amidst plenty are exactly what lead to the end of empires.

That's history. Let's come back to now. What happens....how does all this end? You see, in America, debt levels have soared through the roof, and here's a vivid explanation why. It's not that Americans are foolish spendthrifts, as they're sometimes accused of being—it's that they literally can't make ends meet. So of course when you're spending more than you earn, because what you earn isn't enough, you have to go into debt.

But there's debt, and there's debt. We know this cycle's becoming tapped out, because the lowest quality, and highest risk, and most expensive forms of debt are now growing fastest. Payday loans, online insta-loans, and so forth. That means that people are exhausting the more mundane forms of debt—credit cards, bank loans, government loans, etcetera. They're now resorting essentially to junk debt, whose cycle often becomes inescapable, because the interest rates are so high, and that leaves people in poverty traps—like all those trapped in unpayable "medical" or "student" debt, things which shouldn't exist in the first place.

Where all this ends, then, is several places, and none of them are good. Demagogues—Caesar, Trump, Hitler—surge to power, on the backs of people's trauma and fury, which leave their rational minds broken. Meanwhile, they tend to do absolutely nothing to solve the actual problem, which, remember, in this case, is negative cashflow, or poverty—and so that only gets worse. In America's case, this probably ends with a huge wave of personal bankruptcies, and a banking crisis, which leads on to a larger financial crisis, because of course, who's going to pay all that debt? Meanwhile, it's hardly as if Emperor Trump is going to magnanimously forgive it. So: crisis, destabilization, and collapse.

But even all that, I fear, fail to tell the story well.

What is this? What do we call it when the majority of people can't make ends meet, as in, they're literally spending more than they make, because they don't make enough to live a stable or secure life? That's a depression by any other name. What we economists call a "depression" is a severe downturn in GDP, that persists over the long-run—but here, the average hides the truth. GDP's "growing," but the majority of people are underwater. That can only happen if those at the very top are taking more than 100% of the gains in the economy.

The average person appears to be experiencing something very much like a depression, and has been, it seems for some time now. That's why in places like TikTok, people will wonder and argue that this is a depression. They're right: it's not technically one, but here, technicalities just get in the way. The economy's getting off on a technicality, which is that it's "growing," but it means less than nothing if the majority of people are underwater. It just means that growth is predatory and extractive. For the average person, the experience is precisely that of depression—shrinkage, negative growth—and the statistic, the concept, of an economic "depression" is only there to capture that experience in the first place. That it isn't only tells us the ways we capture in statistics need to be updated to reflect reality.

It's a dire, dire finding. A really alarming and disturbing one. It explains a very great deal, and I've taken you through the explanations and implications, politically, historically, socially. But the point is what you should really get. We should never, ever see a number like this: the majority of people are cashflow negative. Not even in a poor society. Because of course it only portends collapse, from politics to finance to economics. America's despair, in this context, makes altogether too much sense.

Member discussion